Surety Bonds

Unlock your capital. Fortify your business. Secure your growth.

Credeq Surety Bonds give businesses the freedom to grow — releasing capital, diversifying funding, and delivering with certainty. We understand your world, and we move at the speed your business needs.

- Market-leading performance guarantees

- Backed by Swiss Re International (AA- rated), giving clients the same certainty as major-bank strength – without the red tape

- Delivered with Credeq speed and certainty

A guarantee of greater understanding

Credeq takes the time to understand your business, your cycle, and your ambitions.

That’s why leading contractors and miners across Australia and New Zealand choose us

— not just for the facility, but for a partner who backs their business with certainty.

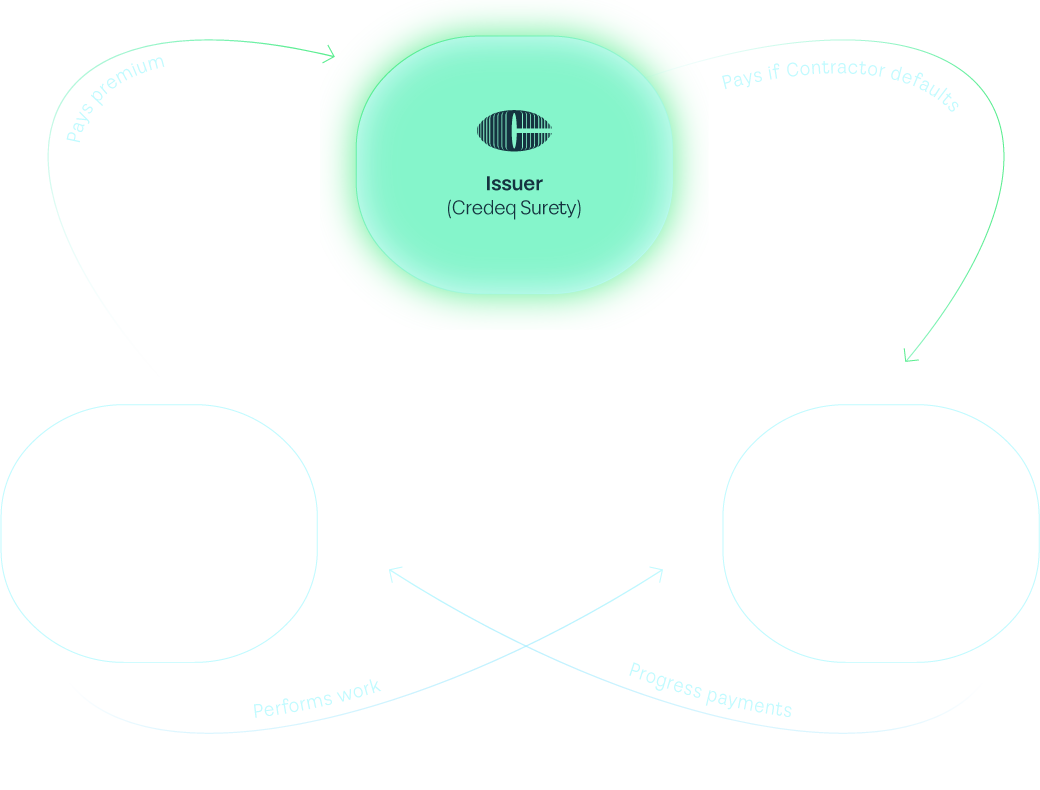

How Surety Bonds work

A Surety Bond is not insurance – it is a guarantee that stands behind your performance

— giving beneficiaries the security they need without draining your working capital.

Unlike traditional alternatives like bank guarantees and cash retentions, it doesn’t typically require cash or assets to be locked away, freeing your balance sheet while still delivering the protection your counterparties expect.

Credeq manages ~$6bn in surety facilities, with limits ranging from $2m to $400m+. Our bonds are issued by Swiss Re International (AA-rated), giving clients the same strength as major-bank strength

— without the red tape.

Who we back

Credeq partners with high-performing Australian & New Zealand businesses in:

Construction, engineering & service providers

Multinational corporations, regional and national contractors, or local contractors spanning a range of industries and sectors.

Mining & resources

Rehabilitation and environmental guarantees for producers of every scale, from Tier 1 to junior miners.

The Credeq advantage

Bank guarantees and cash retentions tie up capital that could be working harder for your business. Credeq Surety Bonds free that capital, improving liquidity and resilience, and potentially funding growth. And when the market shifts, we stand with you — because deep understanding drives stronger underwriting.

Let your assets work for you rather than being tied up as collateral.

Underwriters who understand your sector, your cycle, and your business.

Surety Online Portal for same-day drafts, same-day bonds, and full facility management, plus direct access to decision-makers.

Swiss Re global strength, delivered with local Credeq expertise.

Measured, considered, and built to support you through every phase of the cycle.

Assessment, structuring, and issuance managed entirely in-house by Credeq specialists.

How it works

With the Credeq team, you’re supported at every step — steady, commercial, and committed.

Strength

behind you

For more than 17 years, Credeq has served as Swiss Re’s exclusive Surety managing agent in Australia and New Zealand. That partnership puts AA-rated strength behind every bond — trusted by beneficiaries and built to support your business with global credibility.

Trusted by businesses like yours

FAQs

-

What’s required to qualify?

+We back established, well-managed businesses with strong financials, solid capability, and a track record of delivery.

-

Who issues the bond?

+Credeq handles the underwriting, drafting, and administration. The bond itself is issued on Swiss Re’s AA-rated paper.

-

How fast can bonds be issued?

+For approved facilities, drafts and final bonds can be issued on the same day.

-

Is a Surety Bond an insurance product?

+No. It’s a security instrument, not an insurance policy. Claims are paid on demand, without the assessment process typical of insurance.

-

What’s the difference between a Surety Bond and a Bank Guarantee?

+A Surety Bond is equivalent to a Bank Guarantee in all material respects. It offers the same security to the Beneficiary but is issued by an insurer, not a bank.

Get in touch

Contact

Tel no.

"*" indicates required fields

Discover our full range of solutions

Credeq Australia partners with brokers and businesses across sectors.

Explore our other underwriting solutions designed to deliver compliance and credit confidence across Australia.